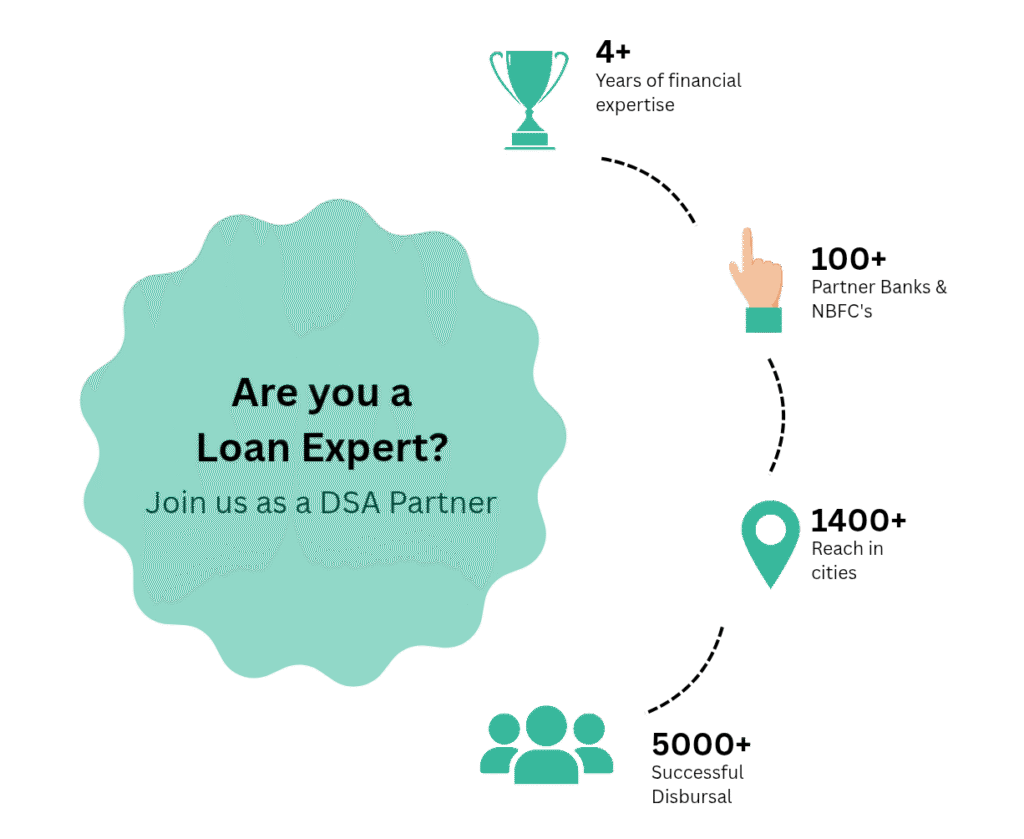

Business Loan DSA Partner with India’s Leading DSA Network

Whether you’re an existing agent or new to the field, we provide the support, tools, and access to top lenders to help you grow your income and client base.

Who Can Become a Business Loan DSA with FinCrest India?

Step into a rewarding career in finance with FinCrest India. Whether you’re a working professional, self-employed, student, or homemaker if you have strong communication skills and a passion for growth, you can become part of our DSA network. We welcome individuals who are ambitious, driven, and eager to unlock new income opportunities by helping people access personal loans. Join FinCrest India today and elevate your professional journey!

About Loan Agent Partner

About Ex-Banker Partner

About Financial Analyst Partner

About Mutual Fund Agent Partner

About Loan Agent Partner

About Ex-Banker Partner

About Financial Analyst Partner

About Mutual Fund Agent Partner

About Loan Agent Partner

You’re a Loan Agent with in-depth knowledge of various loan products offered by the financial institutions you work with. You guide individuals in selecting the most suitable loan options based on their unique needs. Become a FinCrest India Loan Agent Partner and help people fund their goals and aspirations with the right financial solutions.

About Ex-Banker Partner

As an Ex-Banker, you’ve spent years helping individuals manage and grow their money through responsible banking practices—handling deposits, processing loans, and evaluating financial risks. Join FinCrest India as an Ex-Banker Partner and continue supporting people in making smart financial decisions that shape their future.

About Financial Analyst Partner

You’re a Financial Analyst an expert in gathering, interpreting, and analyzing financial data to offer insights and projections. Your advice helps individuals and businesses plan effectively. Partner with FinCrest India and use your expertise to guide clients toward sound financial planning and informed investment decisions.

About Mutual Fund Agent Partner

You’re a Mutual Fund Agent who assists investors in identifying and investing in mutual fund schemes that align with their goals. With your financial acumen, you make wealth creation accessible and strategic. Become a FinCrest India Mutual Fund Agent Partner and help clients achieve mutual financial growth.

About Chartered Accountant Partner

You’re a Chartered Accountant (CA) dedicated to providing accurate financial advice, auditing services, and regulatory support. Your knowledge of tax, compliance, and financial management makes you a trusted professional. Join FinCrest India as a CA Partner and support individuals and businesses in reaching their financial milestones.

About Builder Partner

You’re a Builder who creates spaces where people live, work, and grow ranging from residential to commercial and industrial projects. Your work turns dreams into reality, brick by brick. As a FinCrest India Builder Partner, you can provide clients with the financial support they need to start or complete their dream property projects.

About Builder Partner

What Are the Eligibility Criteria for the FinCrest India Business Loan DSA Registration?

FinCrest India is a leading loan distribution platform, offering a wide range of financial products such as Personal Loans, Business Loans, Home Loans, Loans Against Property, Car Loans (new and used), Credit Cards, and more—across 4000+ cities in India through partnerships with top Banks and NBFCs.

If you’re interested in becoming a Loan DSA Partner or starting your own Loan DSA Franchise, the following are the eligibility requirements:

- Age: Must be 25 years or older

- Nationality: Must be a Resident Citizen of India

- Educational Qualification: No formal educational degree required

- Professional Background: Open to salaried professionals, business owners, self-employed individuals, or anyone looking to build a career in financial services

Step-by-Step Process to Register as a Loan DSA with FinCrest India

Apply Online

Receive a Call

Introductory Meeting

Sign the DSA Agreement

Documents Required for Personal Loan DSA Registration

Mobile number (for registration and communication)

Soft copies of:

- PAN card

- Aadhaar card / Passport / Voter ID

- Two passport-sized photographs

- GST registration certificate (for business entities, if applicable)

- Proof of employment: Salary slips (for salaried), business statements or invoices (for self-employed)Cancelled cheque for bank account verificationCompleted DSA registration form with personal and financial details .

FAQ's

1. Why should I become a Business Loan Partner with FinCrest India?

Partnering with FinCrest India gives you access to a wide range of loan products, competitive payouts, and a trusted brand in the financial sector. We support our DSAs with tools, training, and timely commissions—helping you grow a strong career in finance.

2. What are the benefits of being a Loan DSA with FinCrest India?

- High earning potential through attractive commission structures

- Access to multiple loan products under one roof

- Dedicated support team

- Transparent process and real-time lead tracking

- Training and onboarding assistance

3. How can I apply to become a Business Loan DSA online?

Visit www.fincrestindia.com and navigate to the "Become a Partner" section. Fill in your details, upload the required documents, and our onboarding team will get in touch with you for verification and next steps.

4. Who can become a Business Loan DSA Partner?

Anyone passionate about financial services can join us. This includes:

- Loan agents and financial advisors

- Ex-bankers or finance professionals

- Chartered accountants, builders, and mutual fund distributors

- Self-employed professionals or anyone looking for an additional income stream

5. What are the key responsibilities of a Business Loan DSA?

- Sourcing eligible business loan leads

- Assisting clients with documentation and basic eligibility check

- Coordinating with FinCrest’s team for smooth processing

- Following up with leads and ensuring timely submission