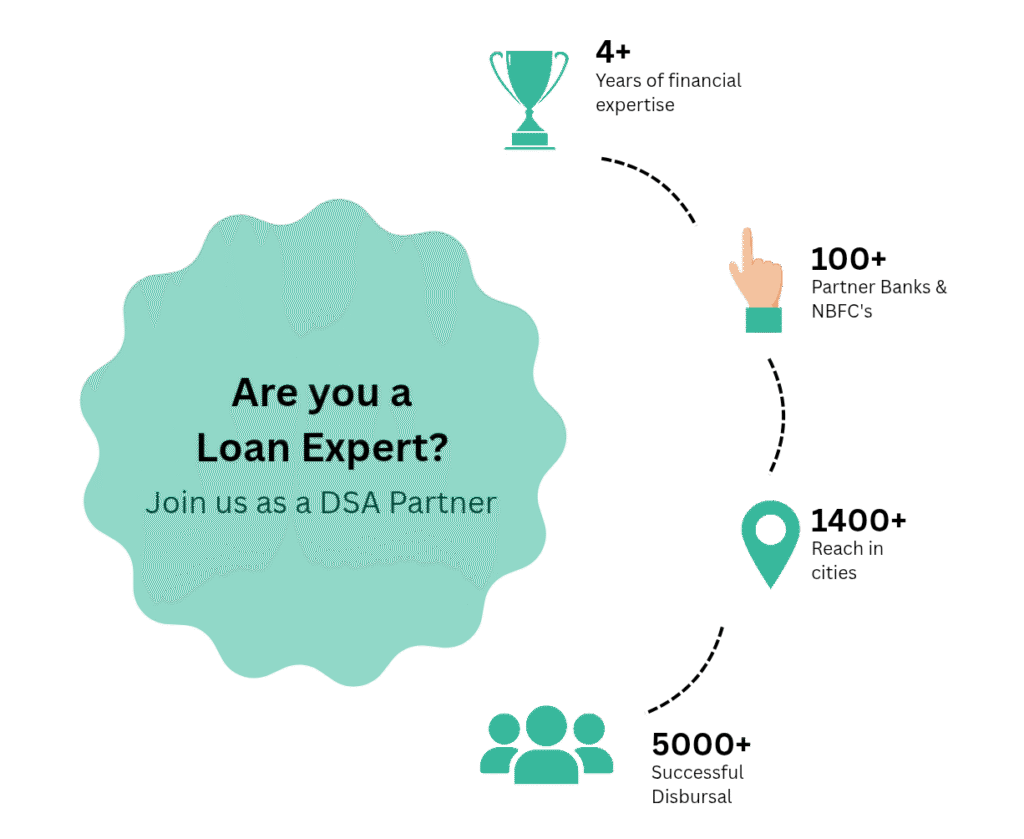

We are India’s Leading Loan Distributor

Unlock Earning Opportunities for All Existing Agents with the Fincrest India Loan Partner Program

Register as a DSA Online with Fincrest India

Step into the world of financial services by becoming a Direct Selling Agent (DSA) with Fincrest India. As one of India’s growing loan distribution platforms, Fincrest India provides access to a wide range of financial products including home loans, personal loans, business loans, car loans, loans against property, education loans, solar loans, machinery loans, gold loans, and insurance offerings.With decades of industry expertise and a footprint across 4,000+ cities, we offer a smooth and professional onboarding experience. Our DSAs also benefit from advanced tools like our EMI Calculator to assist clients more efficiently. Join us in helping millions of customers make smarter financial decisions, and enjoy high-earning potential through attractive commission structures.

What is a Direct Selling Agent (DSA)?

A Direct Selling Agent (DSA) acts as a vital link between borrowers and financial institutions such as banks and NBFCs. DSAs are responsible for:

Finding Customers

Reach out to people in need of loans or other financial services.

Managing Documents

Ensure that all required paperwork is collected .

Advising Borrowers

Educate clients about suitable loan options and help them.

Finding Customers

Facilitating Loan Closures Bridge communication.

Finding Customers

Reach out to people in need of loans or other financial services.

Managing Documents

Ensure that all required paperwork is collected .

Advising Borrowers

Educate clients about suitable loan options and help them.

Finding Customers

Facilitating Loan Closures Bridge communication.

Why Choose Fincrest India as Your DSA Partner?

As a DSA with Fincrest India, you’ll be able to offer a comprehensive suite of financial products, including :

Home Loans

Personal Loans

Business Loans

Education Loans

Home Loans

Personal Loans

Education Loans

Loans Against Property

Business Loans

Gold Loans

Car Loans

Credit Cards

Home Loans

Personal Loans

Business Loans

Education Loans

Loans Against Property

Car Loans

Gold Loans

Credit Cards

Who Can Become a Partner with Fincrest India?

Boost your professional profile and ignite your entrepreneurial spirit! If you have strong interpersonal skills and a drive to succeed, you can join Team Fincrest India as a Loan DSA Partner.

About Loan DSA Agent

As a Loan DSA Agent, you play a key role in helping individuals secure the right financial solutions. With FincrestIndia’s DSA Partner Advantage, you gain access to a wide range of loan products from leading financial institutionsempowering you to assist customers in achieving their financial goals and dreams!

About Ex-Banker Partner

As a former banker, you’ve worked with deposits, discounted notes, and provided financial services that made everyday life easier for people. Now, with the FincrestIndia Ex-Banker Partner Advantage, you can continue supporting individuals by helping them secure the funds they need to grow and succeed.

About Financial Analyst Partner

As a Financial Analyst, your expertise lies in gathering, analyzing, and interpreting data to forecast trends and offer valuable recommendations across sectors. With the FincrestIndia Financial Analyst Partner Advantage, you can guide clients toward smarter financial decisions and a stronger financial future.

About Mutual Fund Agent Partner

As a certified Mutual Fund Agent, you assist and advise investors in choosing the right mutual fund schemes to meet their goals. With the FincrestIndia Mutual Fund Agent Partner Advantage, you can help clients fulfill their investment needs and build wealth for mutual benefit.

About Chartered Accountant Partner

Being a Chartered Accountant means more than just auditing accounts. You provide trusted advice, manage financial systems, and ensure compliance all to bring clarity and confidence to people’s finances. With the FincrestIndia CA Partner Advantage, you can help clients realize their financial aspirations with expert support.

About Builder Partner

As a Builder, you’re in the business of constructing dreams whether it’s homes, offices, or commercial spaces. From new builds to renovations, your work shapes where people live and work. The FincrestIndia Builder Partner Advantage empowers you to assist clients in financing their dream properties with ease.

What Kind of Training Is Needed to Become a DSA?

Loan Categories : Learn about various loan types, applicable interest rates, repayment structures, and borrower eligibility.

Effective Communication : Develop persuasive communication and sales skills to engage clients confidently.

Client Relationship Building : Gain techniques for building trust and long-term rapport with potential borrowers.

Customer Service Excellence : Understand how to deliver an exceptional customer experience and maintain lasting client relationships.

Regulatory Knowledge: Stay updated on guidelines from the Reserve Bank of India (RBI) and other financial institutions.

Documents Required for DSA Registration

Mobile Number

Used for account setup and verification.

PAN Card

Mandatory for identity and tax compliance.

Aadhaar Card (for Individuals)

Proof of identity and address.

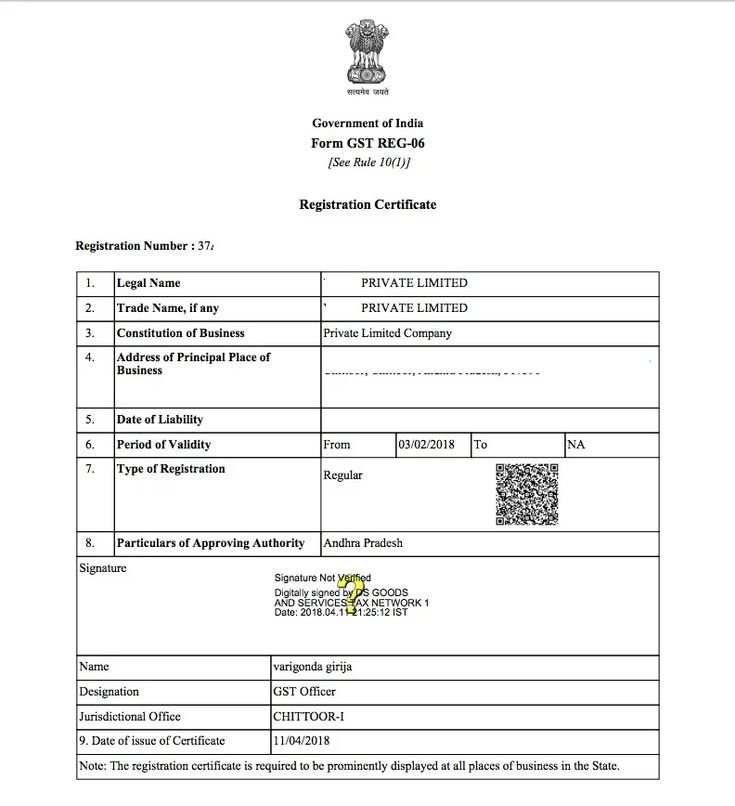

GST Certificate (for Businesses/Firms)

Required for company registrations.

Mobile Number

Used for account setup and verification.

PAN Card

Mandatory for identity and tax compliance.

Aadhaar Card (for Individuals)

Proof of identity and address.

GST Certificate (for Businesses/Firms)

Required for company registrations.

How to Register as a DSA Partner with FincrestIndia

Becoming a FincrestIndia Loan DSA Partner is a simple and streamlined process:

Submit Your Application

Get a Call from Our Team

Attend an Introductory

Partnership Agreement

How to Register as a DSA Partner with FincrestIndia

Becoming a FincrestIndia Loan DSA Partner is a simple and streamlined process:

Lender Referrals

Help clients choose the best financial institution based on their needs.

Improved Career Opportunities

Open doors to a brighter and more rewarding professional future.

Labour Management

Run your business independently without the hassle of managing workers.

Gain Recognition

Stand out, get noticed, and build a personal brand people remember.

FAQ's

Who is eligible to partner with Fincrest India as a DSA?

Anyone with a strong network and interest in the financial services industry can become a DSA (Direct Selling Agent) with Fincrest India. This includes individuals, self-employed professionals, financial consultants, small business owners, real estate agents, or anyone looking to earn extra income by referring clients for loan products.

What are the required documents for DSA registration with Fincrest India?

To register as a DSA with Fincrest India, you will typically need to submit the following documents:

- PAN Card

- Aadhar Card or valid address proof

- Recent passport-size photographs

- Bank account details with a cancelled cheque

- GST certificate (if applicable)

- Business registration documents (for companies or firms)

What criteria must be met to become a DSA Partner with Fincrest India?

To qualify as a Fincrest India DSA Partner, you should meet the following basic requirements:

- Must be at least 18 years old

- Should have a valid PAN and Aadhaar card

- Basic understanding of financial services and loan products

- A stable source of communication (mobile/email)

- Ability to generate leads and network with potential customers

How can I apply to become a Loan DSA Agent with Fincrest India?

Joining Fincrest India as a Loan DSA Agent is simple:

- Fill out the online registration form or connect with the Fincrest team.

- Submit the necessary KYC and business documents.

- Attend a basic onboarding session, if required.

- Once verified and approved, you will receive a partner ID and access to the platform to start generating leads.

What are the advantages of becoming a Loan DSA Partner with Fincrest India?

Partnering with Fincrest India as a Loan DSA offers several benefits:

- High commission structure and timely payouts

- Access to multiple banks and NBFCs for a variety of loan products

- Real-time application tracking and support

- Dedicated relationship manager assistance

- Opportunity to build a long-term career in financial services

Flexibility to work at your own pace and location